Payroll Report Form

Thank you for reporting your payroll online.

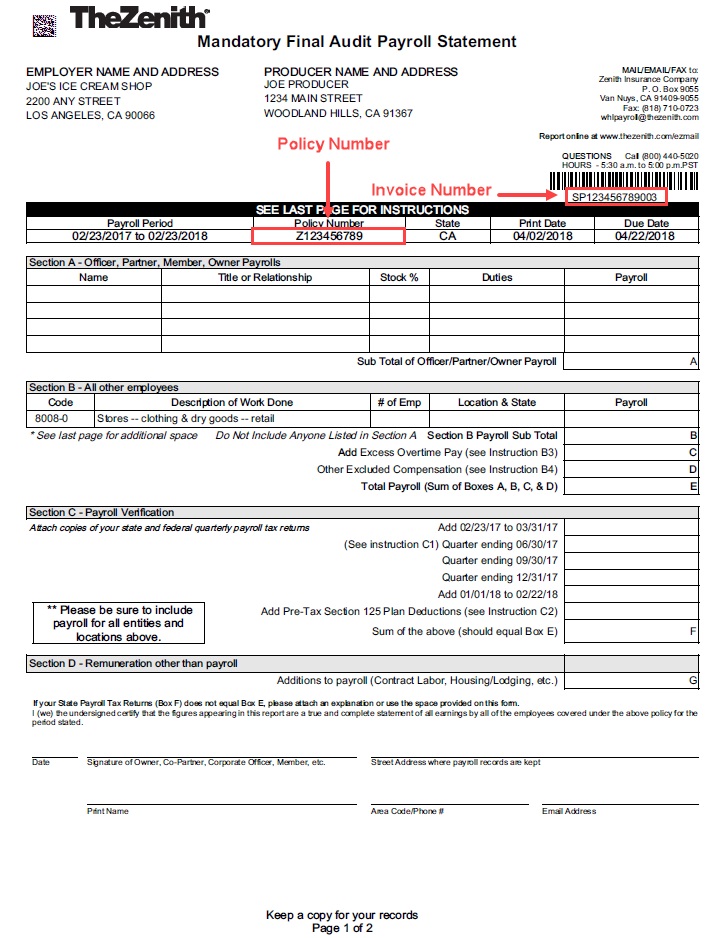

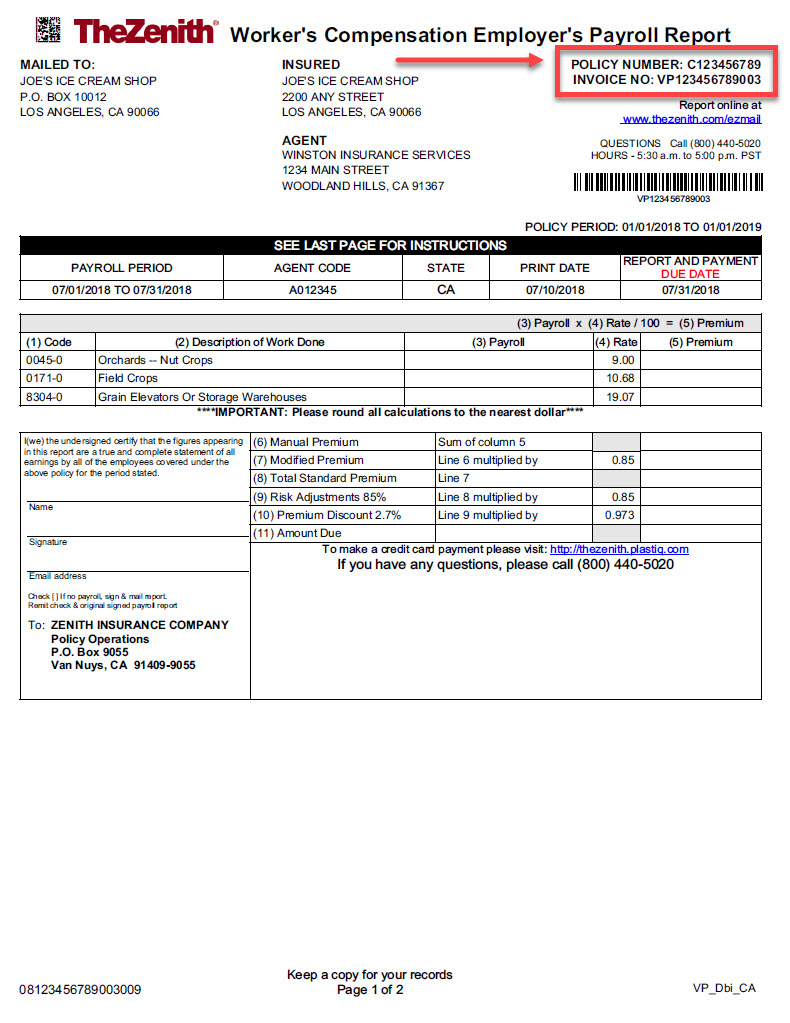

Please begin by entering your Policy Number and Invoice Number. Where can I find these?

Dear Policyholder,

At this time, as we all work to deal with the coronavirus (COVID-19) pandemic, we want to make you aware of a temporary rule change that may help you when reporting your monthly payroll.

If you are continuing to pay your employees who are performing no work whatsoever in your business, either at home or elsewhere, then you may use the new code 0012 "COVID-19" that you will see on your payroll report. This will isolate that payroll from any other chargeable payroll you have, ensuring no premium charge is made.

COVID-19 excluded payroll is defined as payments made to an employee, including sick or family leave payments, while the employee is performing no duties of any kind in service of the employer.

Employers must maintain records that clearly document this change and properly segregate such payments during this time. This information will be verified at the time of final audit.

If you are still open for business and continue to pay your employees for work performed, even though business hours may be reduced, this COVID-19 classification would not apply to you.

Please note that this rule change is pending regulatory approval. We reserve the right to include these segregated payments should the rule change not be approved.

Our customer service representatives and audit experts are here to answer any questions that you may have about your individual situation. Please do not hesitate to call us at (800) 440-5020.

We thank you for your continued business and we hope you and your employees continue to stay safe.

Sincerely,

Zenith Insurance

Dear Policyholder,

At this time, as we all work to deal with the coronavirus (COVID-19) pandemic, we want to make you aware of a

temporary rule change that may be of benefit to you when completing your final audit payroll report.

While we don't anticipate that many small businesses continued to pay their employees during the time their

business was closed, we want to bring it to your attention in case it applies to you.

If you continued to pay your employees who are performing no work whatsoever in your business, either at home

or elsewhere, then you may be entitled to segregate your payroll for this exposure. This would isolate that

payroll from any other chargeable payroll you have, ensuring no premium charge is made for the isolated payroll

(COVID-19 excluded payroll).

COVID-19 excluded payroll is defined as payments made to an employee, including

sick or family leave payments, while the employee is performing no duties of any kind in service of the

employer.

Employers must maintain records that clearly document this change and properly segregate such payments during

this time. You may be asked to submit verification of this with your final audit report. This would only be

applicable during the time of your state mandated stay at home order in your region.

If you are/were still open for business and continued to pay your employees for work performed, even though

business hours may have been reduced, this COVID-19 classification would not apply to you.

Please note that this rule change is still pending regulatory approval in some jurisdictions.

We reserve the right to go back and include these segregated payments should the rule change not be

approved.

Our customer service representatives and audit experts are here to answer any questions that you may have about

your individual situation. If you believe your business may qualify for excluding a portion of your payroll as

described above, please do not hesitate to call us at (800) 440-5020, option #4.

We thank you for your continued business and we hope you and your employees continue to stay safe.

Sincerely,

Scott Perrotty

Senior Vice President

Policy Operations

Zenith Insurance Company

© 2009-2024 Zenith Insurance Company. All Rights Reserved.